Mon - Sat : 11am - 7pm

Mon - Sat : 11am - 7pm

You can start your application online, visit one of our offices, or connect with us via WhatsApp—whichever is most convenient for you.

Visit one of our branches for a free consultation, present the necessary documents, and finalise the loan agreement.

Once your loan is approved, you can receive your cash in 30 minutes

In today’s fast-paced world, managing finances can sometimes feel like navigating through a dense fog. Whether it’s an unexpected medical bill, a sudden need for car repairs, or the desire to consolidate high-interest debt, personal loans can serve as a beacon of hope. However, the decision to take out a personal loan shouldn’t be made lightly. Here’s a comprehensive guide to help you understand when it might be beneficial to consider a personal loan.

Sudden and unforeseeable situations can arise without warning, possibly out of our control too. Such situations can sometimes impair our ability to make sound judgment and decisions calmly and logically. Taking up a loan may be mandatory but because we are sometimes overtaken by our emotions, we may end up borrowing from an unlicensed moneylender. Hence, EZ Loan Pte Ltd is here to provide help and assistance for your needs. As such, EZ Loan Pte Ltd has come up with a guide that will help you in your judgment in determining whether the moneylender you are keen in, is a licensed or unlicensed moneylender, so that you can borrow legally and worry free with us.

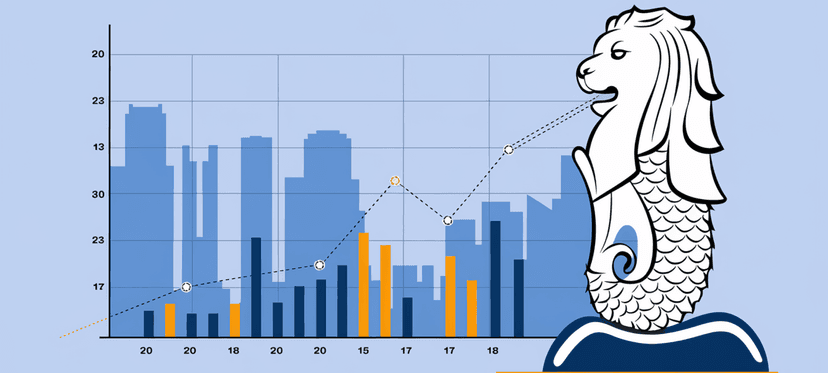

Wondering how much does it cost for a personal loan from a legal moneylender? This article will answer your questions. For all licensed moneylenders in Singapore, the loan amounts and charges are drafted and calculated by adhering strictly to the rates and charges which are allowed, and stated by the Ministry of Law.

Planning your dream wedding can be both an exciting and stressful affair. Between choosing the perfect venue, and finding that show-stopping dress, wedding costs can quickly snowball. But that shouldn’t affect your happily ever after! The solution? Short-term personal loans! In this comprehensive guide, our loan experts at EZLoan explore how you can apply for a wedding loan in Singapore – a helpful financial tool that can bridge the gap between your dream wedding and reality.

At EZ Loan, we understand the unique challenges and opportunities that entrepreneurs and small business owners face in Singapore. Securing a business loan is a critical step for many businesses looking to scale, innovate, or simply manage cash flow more effectively. We’re here to guide you through this process, making it as straightforward and beneficial as possible.

Let’s face it, payday loans are like that friend everyone warns you about but, in a pinch, can be the one who’s got your back. Often criticized for high interest rates and fees, payday loans are not for everyone or every situation. However, when the chips are down, and you’re playing a tight financial game, they can be exactly what you need to navigate through a cash crunch. This blog post dives into the often-misunderstood world of payday loans, shedding light on when and why they might just be a wise financial decision. We’ll explore real-life scenarios where payday loans offer a strategic advantage, helping you decide if it’s the right move for you.

With such volatility today especially with COVID-19 displacing many from their jobs, unforeseen circumstances may drive even the most financially prudent into a tight spot for urgent cash. If you find yourself falling short of your budget before your next paycheck, a payday loan with EZ Loan Pte Ltd may be just what you need.

Ever wondered why some people get approved for loans easily, while others struggle? The answer lies in a little document called a credit bureau report. Don’t have a clue about what this report is all about? Not to worry. In this beginner’s guide, our team of loan experts at EZLoan, a licensed moneylender in Singapore, helps to demystify the credit bureau report!

It is important to understand that credit history or score is one of the biggest factors affecting your financial life. It influences all aspects of life like interest on loans, renting of cars, and positions of employment among others. That is why credit history is a good score that has to be constructed and maintained at all costs. Today, if you have debt or a bad credit score then you should know that there are certain things you can do in order to change all this. Here are some top tips

Advantages of Debt Consolidation Lower Interest Rates For people who may have many high-interest debts

Understanding the various loan options one is faced with is not easy given that there are so many of them. We, at EZ Loan, believe that everyone has a right to access credit facilities and hence we provide solutions to enable you to make the right choices. Here, you will learn all about the various loan options that are offered through EZ Loan so that you can make the most of your borrowing.

In most cases, when one is in the process of getting a loan, one must ensure that the moneylender is trustworthy. EZ Loan, a legal moneylender in Singapore, has carved a niche for itself by offering clients quick, easy, and private financial products. In this blog post, we’ll take a look at the top reasons why EZ Loan should be your first choice when it comes to getting any financial assistance you may need.

Understand the Importance of Credit History It is important to understand that credit history or score is one of the...

What is Payday Loan? With such volatility today especially with COVID-19 displacing many from their jobs, unfores...